Forex Brokers: Crucial Tips for Maximizing Your Trading Possible

Wiki Article

Deciphering the Globe of Forex Trading: Uncovering the Value of Brokers in Handling Threats and Guaranteeing Success

In the intricate realm of forex trading, the duty of brokers stands as an essential aspect that typically remains shrouded in mystery to lots of ambitious traders. The elaborate dancing in between investors and brokers unveils a cooperative relationship that holds the essential to deciphering the enigmas of profitable trading endeavors.The Function of Brokers in Forex Trading

Brokers play an important duty in forex trading by giving essential services that assist investors take care of threats efficiently. These financial middlemans function as a bridge between the traders and the foreign exchange market, using an array of solutions that are vital for browsing the complexities of the forex market. One of the main functions of brokers is to give traders with accessibility to the market by promoting the execution of professions. They provide trading systems that allow traders to market and get currency sets, providing real-time market quotes and making sure quick order execution.In addition, brokers use utilize, which enables traders to manage larger positions with a smaller sized quantity of capital. While utilize can amplify earnings, it additionally enhances the potential for losses, making danger management crucial in forex trading. Brokers give threat monitoring tools such as stop-loss orders and restriction orders, allowing investors to set predefined leave indicate decrease losses and protected earnings. Furthermore, brokers supply academic resources and market evaluation to assist traders make notified decisions and create efficient trading strategies. On the whole, brokers are indispensable partners for investors seeking to browse the foreign exchange market effectively and manage threats efficiently.

Threat Administration Strategies With Brokers

Given the important duty brokers play in promoting accessibility to the forex market and providing danger management tools, understanding effective approaches for taking care of threats with brokers is crucial for successful foreign exchange trading. One crucial technique is establishing stop-loss orders, which enable investors to determine the optimum amount they agree to lose on a profession. This device assists limit possible losses and secures versus negative market activities. Another crucial danger administration strategy is diversity. By spreading out investments across various currency pairs and possession courses, traders can minimize their direct exposure to any solitary market or instrument. Additionally, using leverage carefully is crucial for danger administration. While utilize intensifies earnings, it also magnifies losses, so it is essential to make use of utilize judiciously and have a clear understanding of its ramifications. Keeping a trading journal to track performance, assess past professions, and determine patterns can assist investors fine-tune their strategies and make even more educated choices, eventually boosting danger monitoring methods in forex trading.

Broker Selection for Trading Success

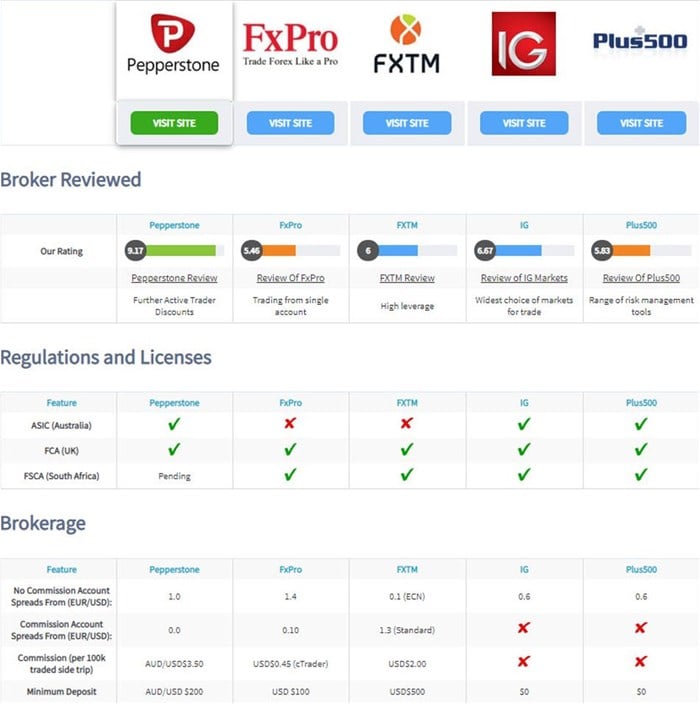

Selecting the best broker is extremely important for attaining success in forex trading, as it can considerably affect the total trading experience and results. Working with a managed broker provides a layer of security for investors, as it guarantees that the broker runs within established guidelines and requirements, hence minimizing the risk of fraud or negligence.In addition, investors should assess the broker's trading platform and tools. An easy to use system with advanced charting tools, quickly trade execution, and a variety of order kinds can boost trading efficiency. Additionally, taking a look at the broker's client assistance services is crucial. Motivate and reliable consumer assistance can be invaluable, specifically during volatile market problems or technological concerns.

In addition, traders must evaluate the broker's fee framework, consisting of spreads, commissions, and any type of covert fees, to comprehend the price effects of trading with a particular broker - forex brokers. By very carefully reviewing these elements, investors can pick a broker that straightens with their trading objectives and sets the stage for trading success

Leveraging Broker Know-how for Earnings

How can traders effectively harness the expertise of their picked brokers to optimize earnings in foreign exchange trading? Leveraging broker experience for revenue requires a calculated technique that involves understanding and using the services used by the broker to enhance trading results. One essential method to leverage broker know-how is by making use of their research and analysis devices. Lots of brokers provide accessibility to market insights, technological analysis, and economic calendars, which can aid investors he said make notified decisions. By staying educated regarding market fads and occasions through the broker's sources, investors can identify rewarding possibilities and mitigate dangers.Establishing a great connection with a broker can lead to tailored suggestions, trade suggestions, and danger administration methods customized to individual trading designs and objectives. By connecting regularly with their look at here brokers and looking for input on trading strategies, traders can tap right into skilled expertise and boost their total performance in the foreign exchange market.

Broker Support in Market Evaluation

Additionally, brokers can give prompt updates on financial events, geopolitical developments, and other aspects that might impact currency rates, making it possible for investors to stay ahead of market variations and change their trading positions appropriately. Ultimately, by utilizing broker aid in market evaluation, investors can boost their trading performance and increase their possibilities of success in the affordable forex market.

Final Thought

In final thought, brokers play an important function in foreign find here exchange trading by handling threats, offering proficiency, and assisting in market evaluation. Choosing the ideal broker is necessary for trading success and leveraging their knowledge can cause revenue. forex brokers. By making use of danger management approaches and working carefully with brokers, investors can browse the intricate world of forex trading with confidence and increase their possibilities of successProvided the vital role brokers play in helping with access to the international exchange market and providing risk management devices, recognizing efficient techniques for handling risks with brokers is necessary for effective foreign exchange trading.Selecting the best broker is paramount for attaining success in foreign exchange trading, as it can substantially influence the overall trading experience and end results. Functioning with a regulated broker provides a layer of safety for investors, as it ensures that the broker runs within set requirements and standards, thus decreasing the threat of fraudulence or negligence.

Leveraging broker expertise for revenue calls for a strategic technique that entails understanding and making use of the solutions provided by the broker to boost trading end results.To efficiently capitalize on broker experience for revenue in foreign exchange trading, investors can rely on broker aid in market evaluation for educated decision-making and risk mitigation techniques.

Report this wiki page